To stay competitive, it’s essential to understand how your customers are interacting with your brand. For digital companies, this typically starts with product analytics. Broadly, the goal of product analytics is to understand user behavior and identify which product experiences lead to customer success and which lead to customer friction or churn. Product analytics can help businesses answer questions like: What are users doing in the product? How do different segments behave and perform? When does attrition begin? And what are our funnels and pathways of engagement?

Not surprisingly, product analytics is heavily leveraged in departments charged with delivering products: Product Management, Design, and Engineering. Marketing and Growth teams also leverage product analytics by treating a website or ad campaigns as part of the product-led growth (PLG) experience.

The current first generation of product analytics tools are vertically-integrated solutions, that in their own data siloes, are designed to provide top-level visibility into outcomes in product channels only. But how do you understand patterns of behaviors across all touch points that drive those outcomes?

Next-generation product and customer analytics tools cut across product instrumentation data and all other customer business data (sales, support, marketing, finance, success etc.). They are architected for the modern data stack, working natively on data warehouses. With complete customer context (in-product and outside), and with the exploratory power of BI, they enable deep understanding of how behavioral patterns drive cross-functional business outcomes. They provide a shared, consistent, and easily accessible view of customer behavior for all customer-oriented teams in the enterprise As a result, they offer richer, more business-impactful analytics.

Challenges with 1st-gen product analytics

The first generation of product analytics was born out of Web 2.0. The tools that emerged (Mixpanel, Amplitude, Heap, etc.) have served product-driven companies well by providing top-level visibility into product usage that they didn’t have before. However, in today’s digital landscape, there are several challenges and deficiencies with 1st-gen tools. These include:

1. Added costs of closed legacy stacks

1st-gen tools have built proprietary closed data stores for the event data they collect – and then price based on event volume, even if the data is not used. This doesn’t scale beneficially for customers, as event volume is not necessarily correlated to business value.

Having a closed data store is typically messaged as a necessary step to generate analytic performance. This wasn’t controversial before the emergence of the modern data stack and centralized data stores. But that data is not in industry standard formats, nor is it exposed through standard APIs such as JDBC and SQL. This results in yet another a black-box, siloed data store.

For even a moderately large amount of data or analytical complexity, customers have to build ETL jobs to dump data out of these stores into other databases. They then have to use yet another tool to analyze this data, creating fragmented analytics, more overhead, and increasing the TCO of their analytics machinery.

2. Siloed single-channel visibility

1st-gen tools focus on a single channel: the in-product experience. While that data provides some insights, it’s incomplete. In a multichannel, always connected ecosystem, customers interact with brands not just through their instrumented products, but also through out-of-product channels like social, customer support, marketing, events, and perhaps even offline channels. Product analytics tools generally offer little, if any, support for multichannel analysis.

That’s because 1st-gen tools fundamentally lack the ability to enrich product data with any data from other customer business systems. For example, a tool may offer a well-modeled notion of a “user” based on the events being captured in the product or application. But what is the complete profile of this user? Are they a power user that’s part of an account paying $1M and up for renewal this quarter? Customer engagement or financial systems possess this data. Other examples of business context include supply chain, sales history, or support channels, from data living in Oracle, Salesforce, Zendesk, or the data warehouse. This data is simply not in the event streams for 1st-gen product analytics tools

At best, 1st-gen tools can bring in a limited set of properties from an enterprise data warehouse using reverse ETL tools. This is fragile and expensive, and always incomplete as requirements are constantly changing. While it certainly doesn’t scale, it further contributes to the fragmentation of analytics solutions in the organization.

3. Data outside the enterprise

1st-gen tools capture user behavior and store data within their vertically-integrated SaaS service, outside of the secure enterprise environments. Their tag-first approach used by business users, are inherently prone to security and privacy violations. This creates significant business risk for enterprises given the increasing regulatory pressures.

4. One-size-fits-all canned analytics

1st-gen tools are designed to provide out-of-the-box reporting templates for basic self-service reporting. Unlike business intelligence (BI) software, which has slice-and-dice capabilities for advanced ad hoc analytics, product analytics solutions generally offer only pre-defined reports on rigid data models. Moreover data collection and processing is designed to fit this pre-defined data model, and data that’s not needed to produce the prescribed reports, is discarded along the way.

What if the user wants to ask a follow-up question, and it’s a domain or business-specific question that goes beyond those reporting templates? The workarounds today are painful. Typically, you’ll need to export all the product telemetry (or at least what telemetry remains from the prescribed data collection process) into a relational data warehouse, and write complex SQL for modeling and analyses. The users of product analytics tools are business users — they likely don’t have the latest skills or access to tooling to do this. As a result, they have to rely on overloaded and organizationally expensive data engineering and data science teams.

5. Performance at scale

1st-gen tools evolved from basic reporting templates for simple use cases with simple computation engines. They weren’t designed to scale to support the sheer amount of raw data that businesses are capturing today. And to avoid performance degradations, these tools summarize and purge large amounts of high-fidelity data that could otherwise provide answers to important business questions.

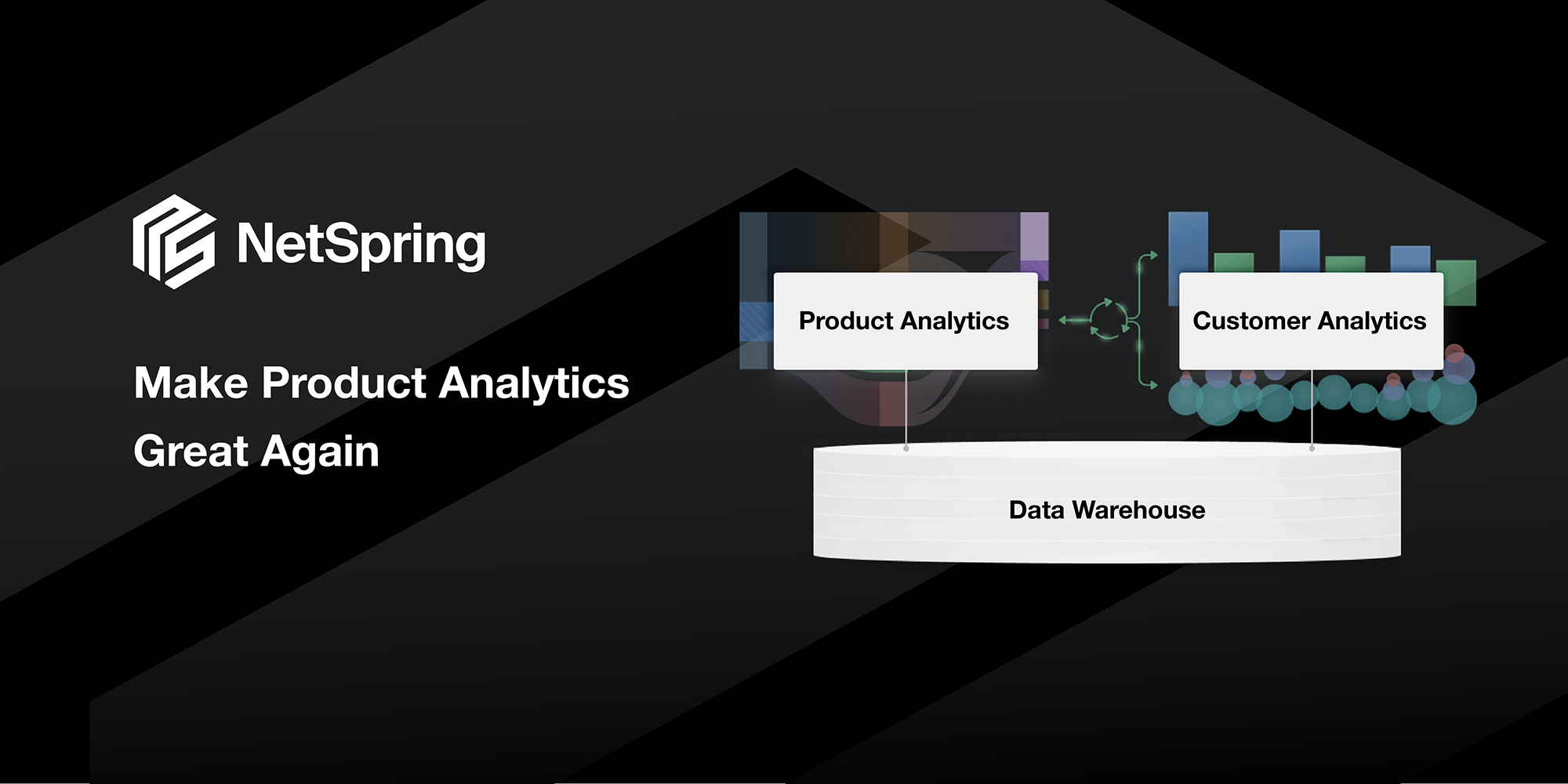

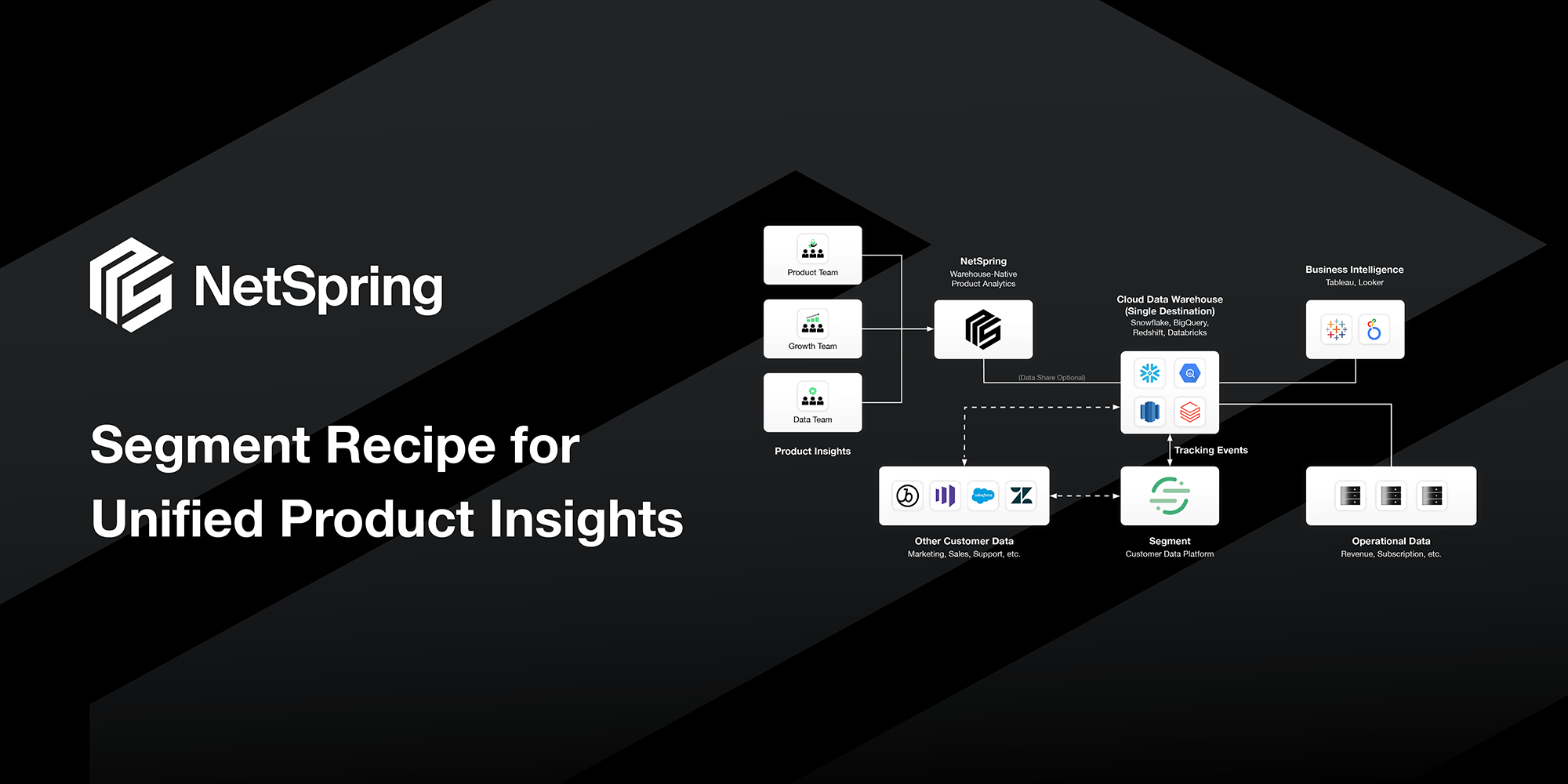

Next-gen product and customer analytics is warehouse-native

In the modern data stack, analytics tools and capabilities like BI, AI and ML already work directly on the data warehouse. Why shouldn’t product analytics? To address the challenges of 1st-gen product analytics tools, a new generation of warehouse-native apps is emerging. Here are the analytics capabilities unlocked by this modern approach:

Self-serve answers to any question

Next-gen tools allow business users to self-serve for data access, modeling, and analytics, with minimal reliance on data engineering teams. No longer confined to prescribed reports or dashboards, business users have intuitive point-and-click interfaces for accessing, analyzing and visualizing data – from any data source in the data warehouse.

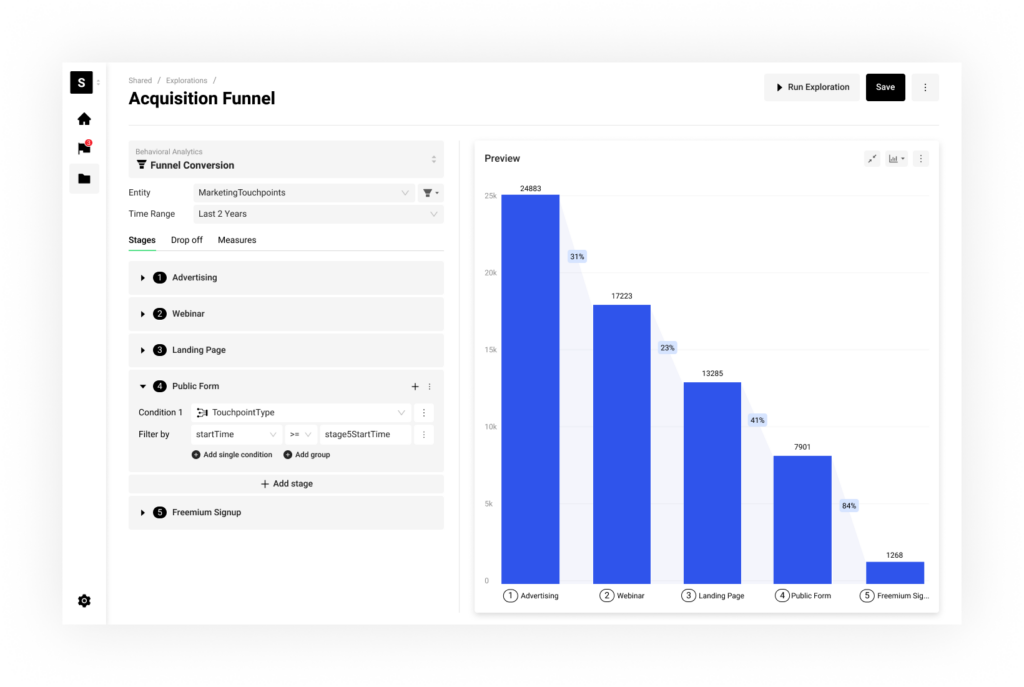

Starting from dozens of product analytics reporting templates, including event segmentation, behavioral cohort, retention, paths or funnels, business teams can quickly get an understanding of user behavior and outcomes.

They are able to enrich and extend the organization’s data model according to their domain expertise. And ultimately they will be able to ask more sophisticated questions with advanced analytics.

Seamlessly answer the next set of questions

The next question, and the next, and the next… may be sparked by curiosity around interactions outside the product or OKRs at the account- or business-level. It is iterative and builds at the speed of thought, and this requires ad hoc visual exploration capabilities. Fortunately, the data required to support this already sits in the warehouse and is immediately accessible for this type of self-guided exploration.

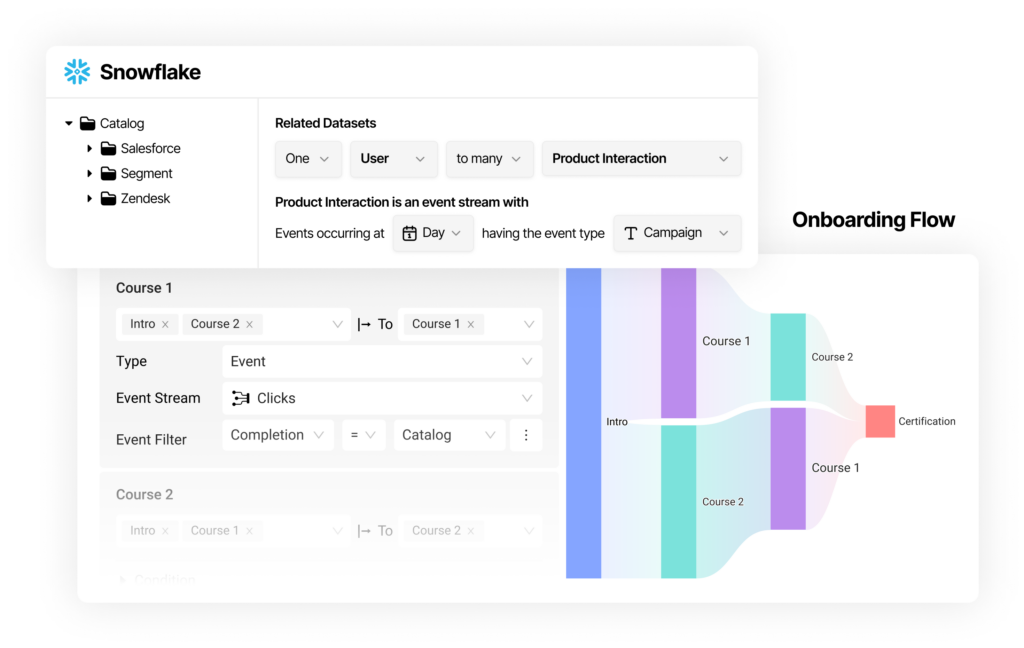

Converged platforms for self-service BI and customer analytics are designed for business users to now easily ask these more sophisticated questions from a single platform – on any customer or business data, and across higher order business metrics, beyond product usage (e.g. a streaming company can track Cost Per Acquired Hour to measure marketing ROI based on the customer acquisition cost for every hour of content viewed).

Organizations aren’t limited to looking at the behavior of users in the product. They can seamlessly iterate and refine their understanding of user behavior, as they slice-and-dice across any dimension of data in the warehouse. For instance, they can easily roll up to account-level behavior or attribute usage to upgrades and directly to revenue! They can see how users behave across other touch points, compare past historical behavior with dynamically evolving cohorts, and more.

With rich business context and insights from across data sources, they can personalize customer outreach at the very point of business impact.

Accurately model your business for full context

These tools offer the advanced modeling capabilities of self-service BI tools.

They allow the organization to schematize raw data in various forms into meaningful relational business entities, with multiple views of the data for various business scenarios, support for semi-structured data, and resiliency to changes in the source data.

React quickly to changes in your business

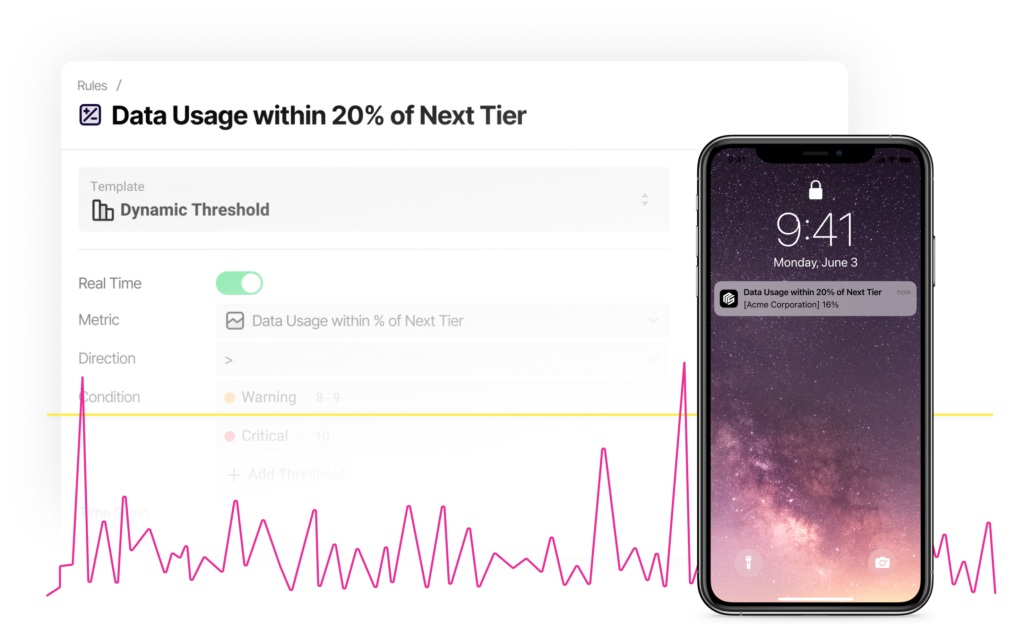

We are in an era of rapid increase in the velocity of business. Every team, be it Product, Growth, or Customer Success, needs to react to business events faster than ever before to stay relevant, meaning they need to have a real-time pulse on their customers and operations. Next-gen analytic systems reflect this evolution. They’re capable of processing user event data in real-time, and instantly alerting Product and customer-facing teams about issues and opportunities.

Activate insights to personalize experiences in any channel

When business systems are not in sync, what you thought was a well-timed personalization may be completely off the mark and detrimental to the relationship. Maintaining and operationalizing off a single source of truth is the only way to avoid this.

Next-gen tools push insights from behavioral analytics down into the data warehouse, the single source of truth, for activation by and from any business system connected to the warehouse.

Address privacy and security concerns

Because next-gen tools are warehouse-native, data is never duplicated and never leaves a customer’s secure environment.

Moreover, customers have the flexibility to deploy either as a fully managed SaaS service or within a their own Virtual Private Cloud (VPC). This allows customers to adhere to common corporate security and privacy policies for all applications.

Pay for value

Next-gen tools are built from the ground up for the modern data stack. In the modern data stack, all data, including product instrumentation data, resides in a centralized cloud store, in an open format alongside all other customer business data. You pay for data once. There is no additional ETL or reverse ETL to move data between other external, black-box silos. You can cheaply store all your data in Cloud object stores, but only pay for whatever subset of that data is queried.

Analytics tools are decoupled from instrumentation, working directly off data in these central stores. This enables next-gen product analytics to offers the analytical power of BI from a single platform. You no longer need multiple platforms and tools to serve the range of product analytics queries, from simple (1st-gen tools) to sophisticated (ETL/SQL/BI tools). Moreover, since queries are direct against the data warehouse, you have full price transparency on your compute costs.

By modernizing your product analytics stack, you will only pay a fraction of what you’re spending now for multiple tools, platforms, and teams.

Take your product and customer analytics to the next level

Are you struggling to overcome the challenges of your current product analytics solution?

- Event-based pricing that gets prohibitively expensive at scale

- High TCO of data movement to/from closed legacy stacks

- Siloed single-channel visibility

- Customer data outside the enterprise

- One-size-fits-all canned analytics

- Fragmented analytics in multiple products

- Poor performance at scale

More importantly, are you expecting more business impactful insights from a modern platform?

- Fraction of the cost of legacy product analytics solutions

- Self-serve answers to any question

- Seamlessly answer the next set of questions beyond templated reports

- Accurately model your business for full context

- React quickly to changes in your business

- Activate insights to personalize experiences in any channel

- Address privacy and security concerns

- Pay for value, not data volume

If you answered yes to any of the above you should be considering a next-generation Product and Customer Analytics solution, to maximize the value of your investment in product instrumentation, and begin asking more sophisticated behavioral questions. Contact us to get a demo.