Over the holidays, someone asked me this question – “Why is it that Amplitude, the market leader in Product Analytics, is valued only at ~$1B after being in existence for over a decade? Is it is a sign that the product analytics space is dead?“.

My response in a nutshell was “Product Analytics is not dead. Far from it. It is even more important today. But the the way we think of product analytics, and the tools we have been using for it, need to change radically. The space needs a re-boot“.

Let me explain.

The early evolution of Product Analytics

First, let’s try to understand how traditional product analytics tools like Amplitude evolved. They emerged a decade ago when a large number of mobile apps and product-led SaaS services became pervasive. It was critical to get an understanding of product usage by users, particularly in consumer-oriented products where churn was high. At that time, there were no good options to do this well. The analytics tools were primarily BI tools like Tableau and Qlik. These tools were good for reporting on ERP, CRM, HCM, etc. data in the warehouse. But they could not be used for product analytics because:

- Event data from product instrumentation never reached traditional data warehouses. Data warehouses were not designed to ingest, store, and process event data in a performant and cost-effective way.

- BI tools were not designed for expressing or computing event-oriented analyses.

- Fast moving digital product and marketing teams needed a quick solution that did not depend on slow-moving central enterprise data teams.

As a result of the above limitations, purpose-built, packaged tools for product analytics emerged; tools that included everything in a single SaaS service – instrumentation, storage, compute, and visualizations. For once, product and growth teams were able to get visibility into their product’s usage. They were able to perform basic analysis such as event segmentation, funnel, paths, etc. using ready-made templates. They were able to use these analyses to optimize product features. This was a huge breakthrough.

The trough of disillusionment

Product and Growth teams started adopting these tools widely. Huge amounts of money were spent on these tools that got very expensive as companies grew, and their event volumes increased rapidly. There was a belief that business-impactful decisions would be made based on analytics in these tools, and the spend on these tools would pay off. However, disillusionment set in soon because:

- The analytics in these tools was so siloed on such limited (and often poor quality) data, that no significant business-impactful decision could be made on it.

- The cost was so high, that when compared to the benefits, the ROI was just not there.

- Beyond the first, basic analytics in these tools, business teams ended up calling Data teams to build them reports for the second level of insights, often struggling to explain requirements, waiting for weeks to get reports, and not being able to get analytics fast enough for it to be actionable.

- Data teams struggled with extracting data from proprietary product analytics tool “black holes” into the data warehouse, and using a BI tool (the wrong tool for product analytics, but the only tool available!) to produce reports.

- Analytics became fragmented across product analytics and BI tools, with very low trust in the numbers produced by product analytics tools.

- Security teams, with increasingly demanding compliance and governance requirements, limited the data that could be sent to external analytics services, contributing to their diminished analytical value.

Today we are in the trough of disillusionment with product analytics

Product Analytics has not lived up to its promise. Companies that spent a lot of money on traditional product analytics tools, are scaling back on their investments. Product analytics tools have gone from must-have to nice-to-have. It is no wonder that the majority of product analytics today is not done in traditional product analytics tools! They are done (painfully!) in BI tools. This trend is accelerating, and that is why the product analytics market leader’s valuation is low.

Has the need for Product Analytics gone away?

Not at all. The need for product analytics has not gone away. If anything, it has only increased, as more and more software is consumed as subscription SaaS services, and product-led growth becomes the primary business methodology for more and more product-led companies. Having a deep understanding of product usage and customer behavior is critical for survival in a competitive market. The need for product analytics is absolutely there, and the need is growing. The TAM is big and still largely untapped. But we need a fundamental re-boot to the way we think about product analytics.

Evolving from Product Analytics to Customer Analytics

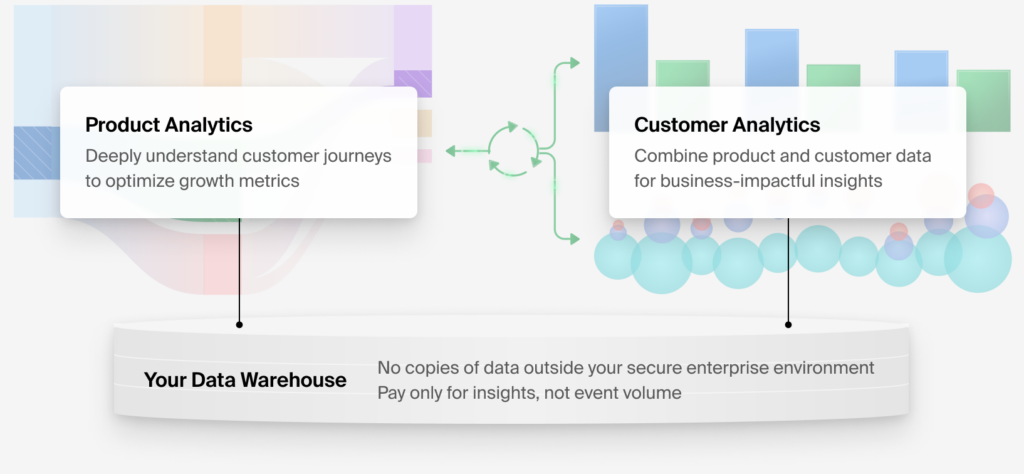

The first step in the re-boot of product analytics is to not think of product analytics anymore, but rather to think of a broader “Customer Analytics”. Customer Analytics is analytics across product instrumentation data and all other customer business data (sales, support, finance, marketing, success, etc.).

Customer Analytics is business impactful, while Product Analytics is not

Analytics is no longer just about usage of product features; rather it is about how the usage impacts business – such as revenue generated or support escalations caused. It is about retention numbers that are not misleading because it now correctly includes cancellations outside of product. It is about optimizing the right set of features for the right set of accounts, that generate the most revenue. It is about measuring marketing impact not just by number of signups following a campaign, but on longer-term economic value of acquired customers. It is about understanding customer journeys not just in product, but also across all channels such as store, support, chat, loyalty programs, partners etc. It is about success and support teams driving more CSAT and retention by understanding behaviors of users in their accounts. It is about operational teams being able to evaluate the business impact of product/site experiences, and using that to prioritize issues better.

Customer Analytics provides a shared, consistent, and easily accessible view of customer behavior for all customer-oriented teams in the enterprise, cutting across all customer touch points – in-product or outside product

No more data silos. No more analytics silos.

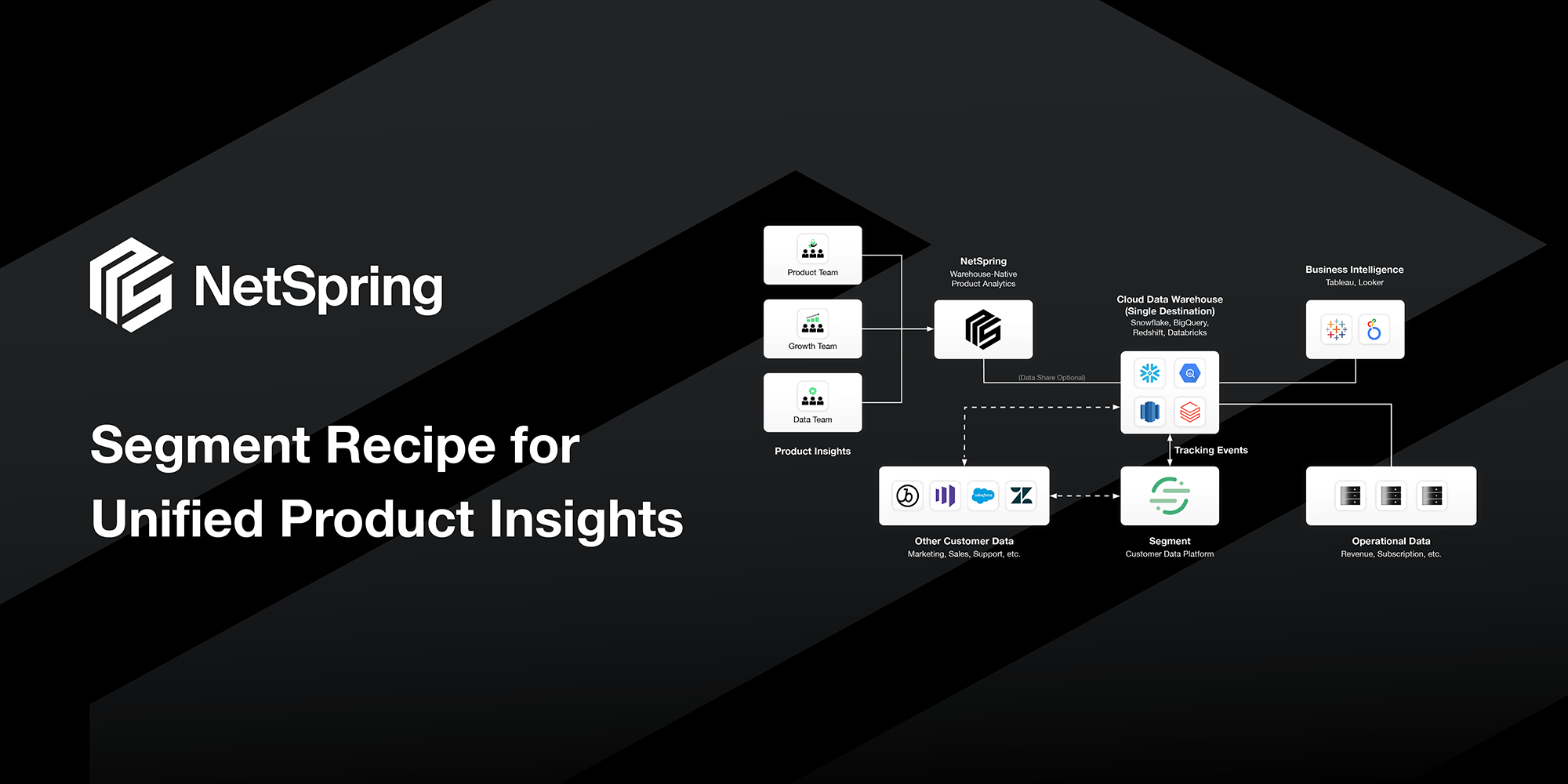

Breaking the data silo

The first step to realizing the Customer Analytics vision is to break data silos and converge on a single data store. In enterprises today, the undisputed single store for all data is the data warehouse/lake. Modern cloud data warehouses/lakes such as Snowflake, BigQuery, Redshift, and Databricks have ushered in the consolidation of all data into a single store. While the warehouse has always been the central place for data used in business reporting, the big change now is that modern warehouse/lakes are also becoming the central place for event-oriented data e.g. clickstream, IoT, logs, devices data. It is now feasible to ingest and store this type of data too in the warehouse/lake quickly and efficiently.

The data warehouse/lake is the center of gravity of all data in the enterprise – event data and state data

All applications, including Customer Analytics, should adapt to this change and re-tool to avoid copying data out to their proprietary silos.

Next-generation CDPs

The CDP space, which is directly related to product analytics, is being re-defined too. CDPs emerged as a Marketing solution that was disconnected from the central enterprise data systems and teams. While they provided quick value in the early years, they have suffered from the same pain of siloed systems. Today, next-generation, composable CDPs are being re-built on top of the data warehouse with best-in class tools – RudderStack and Snowplow for instrumentation, Hightouch and Census for activation, DBT for data transformations related to identity resolution, sessionization, etc. and ML capabilities in the warehouse ecosystem for attribution and prediction.

At the core of Customer Analytics is of course the Customer entity. Higher the quality and richness of the Customer entity, the better the analytics.

Next-generation CDPs, with their rich customer data models, are an enabler for richer customer analytics

Breaking the analytics silo

Once you have a single source of all data in the warehouse/lake, the next step is to have a single analytics tool for all customer-oriented analytics that can leverage this data. Analytics tools have a layer of metadata (such as definition of metrics) above the tables in the warehouse/lake. Having a version of this metadata in many different tools results in multiple sources of truth that absolutely has to be avoided. Context sharing across multiple tools, even if they are working off the same underlying store, becomes difficult because they each have their own representation of context e.g. a cohort of users that dropped off between two stages of a funnel. A single Customer Analytics tool avoids these issues of fragmented and weak analytics.

A single Customer Analytics tool serves the needs of Product, Growth, Marketing, Sales, Success, and Support teams for all their analytics needs

This has not been possible historically because event-oriented systems (such as Product Analytics) and state-oriented systems (such as BI) are architected differently in their metadata representations and computation mechanisms. However, this is just the way these systems have evolved historical. While technically challenging, it is possible to have a single analytics tool that can bring together the event and state oriented worlds together.

Building trust

With a single analytics tool working off a single source of truth with no copies, trust in numbers is built up within the organization. A retention number, for example, that is calculated in this single tool is the same number quoted by all teams, and can be presented to the C-Suite with confidence. The tool should have audit capabilities to be able to see the exact SQL that was issued to the underlying warehouse/lake for independent verification of any analytical computation.

With trust in numbers comes more usage of analytics across all teams in the enterprise, and more business value

Generating ROI

With a broader Customer Analytics platform, the ROI is much higher. Costs are lower with no data copies and no management of data movement jobs. Processes are efficient with no wasted time debugging discrepancies across silos. Security and governance costs are reduced with a single copy of the data under the enterprise’s control, and with carefully controlled access to the central store. With analytics becoming more business impactful by incorporating richer business context and serving multiple teams, the spend on analytics can easily be justified.

Customer Analytics tools can potentially provide an order of magnitude better ROI that traditional Product Analytics tools

Vendor and tool consolidation

If you think of customer analytics as a combination of product analytics, marketing analytics, and digital experience analytics, and map it to the current set of vendors, you see a lot of fragmentation and overlap. But a much needed consolidation trend has already begun. Contentsquare’s acquisition of Heap, Adobe’s announcement of a product analytics offering, Mixpanel pitching marketing analytics, Amplitude launching session replay, FullStory offering product analytics, etc. are signs of this consolidation. In addition to this, we need to see the consolidation of the majority of event-oriented analytics done today in generic BI tools, into a first-class Customer Analytics tool.

The dominant vendor in this space is going to be one that is able to provide a cohesive, yet composable, Customer Analytics suite on a modern data warehouse/lakehouse architecture

Gartner Magic Quadrant for Customer Analytics?

Gartner’s Magic Quadrant (MQ) for a space is often a sign of maturity of that space. Typically an MQ appears when the 2nd generation of tools emerge in a broad, well-defined, cohesive category. My prediction is that we will see a Gartner MQ for Customer Analytics in the next couple of years, that encompasses product analytics, marketing analytics, and digital experience analytics.

Make Product Analytics Great Again!

Using the phrase in jest, and with no intention to ruffle any political feathers, let me make a plea to “make product analytics great again!” This is still an emerging area where as much as a third of the market is not even tapped. Let this greenfield segment start off on the right foot with a modern analytics platform. For the segment of the market that has become disillusioned, let’s do right by them. Let’s offer a new breed of analytics that generates great value for them.

At NetSpring we are working hard towards this Customer Analytics vision. If you want to see how, watch a demo here. If have thoughts about the space in general, do leave a comment.

For more related reading on this topic, see these great blogs from John Humphrey one of the best thinkers in the data space in general, and the product analytics space in particular: